The Twenty-Fourth Amendment ended poll taxes in the southern states.

WHAT IS THE TEXT TO THE TWENTY-FOURTH AMENDMENT TO THE CONSTITUTION?

U.S. CONST. AMEND. XIV. ELIMINATION OF POLL TAXES

Section 1: The right of citizens of the United States to vote in any primary or other election for President or Vice President, for electors for President or Vice President, or for Senator or Representative in Congress, shall not be denied or abridged by the United States or any State by reason of failure to pay any poll tax or other tax.

Section 2: The Congress shall have power to enforce this article by appropriate legislation.

WHAT IS THE HISTORICAL ORIGIN OF THE TWENTY-FOURTH AMENDMENT?

What Were the Black Codes?

When the South lost the Civil War, they wasted no time in impeding the lives of newly freed African-Americans. Although the southern states were beholden to the Thirteenth Amendment and other federal laws, the individual states could still create their own legislation before and during the Reconstruction Era. Mississippi and South Carolina led the way with the Black Codes, a series of strict, discriminatory labor laws that often resulted in jail time or indentured servitude for poor African-Americans. For example, Mississippi required them to have written evidence of employment. If they left their jobs before the end of the year, they would be arrested.

Outrage from the North and ratification of the Fourteenth Amendment and the Fifteenth Amendment briefly deterred the South’s harsh treatment of African-Americans, who finally had the chance to thrive politically. Black men would arrive in droves at the polls to exercise their right to vote. Some were even able to hold office. But this was short-lived. When the Reconstruction Era ended in 1877, the federal government withdrew its soldiers from the southern states. No longer under scrutiny, southern lawmakers—many of whom disagreed with the three new amendments—revived the Black Codes but in a more insidious form.

What Were the Jim Crow Laws?

The Jim Crow laws were a series of discriminatory statutes and laws aimed at segregating black people. They were unofficially named after a fictional character who performed minstrel acts and was portrayed by a white actor in blackface. Southern white supremacists were alarmed at the rising successes of black citizens and sought legal methods to control them. These laws restricted African-American freedoms and civil liberties by impeding their right to own property, get an education, hold a job, and even who they can marry. Breaking these laws led to severe penalties that included heavy fines, arrests, beatings, and even death.

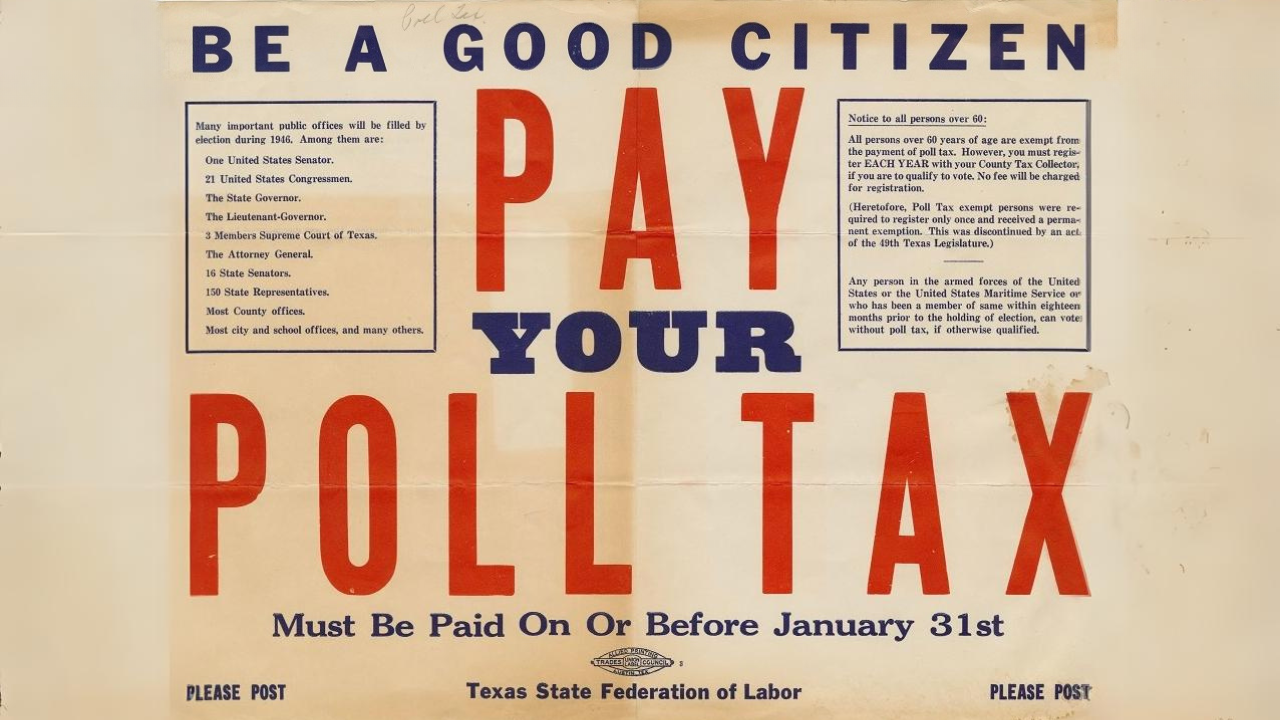

Since white supremacist lawmakers wanted to disenfranchise black Americans, they created Jim Crow laws to deter them from voting, which legally undermined the Fourteenth and Fifteenth Amendments. Poll taxes were one such method. The southern states had required that would-be voters must first pay a fee to enter the polling areas. Since many African-American men were extremely poor, many of them therefore could not vote. Other methods included literacy tests (i.e., one needed to know how to read) and “grandfather clauses”, in that a man can vote if their grandfather was able to vote. Grandfather clauses allowed poor and uneducated white men to vote, but kept black men out of the polls since their grandfathers were likely slaves and thus ineligible. Over the next several decades, the Jim Crow laws worked perfectly to disenfranchise black men, severely reducing the number of black voters from about 90 percent during Reconstruction, to a mere three percent in 1940.

Court Cases that Supported Poll Taxes

Although black Americans and activists decried poll taxes, they were perfectly legal because they didn’t appear discriminatory. They affected everyone who was eligible to vote. However, a few court cases did question their validity.

In Breedlove vs. Suttles (1937), a young white male voter named Nathan Breedlove declined to pay Georgia’s $1 poll tax and thus could not vote. He filed a suit claiming that the tax violated both the Fourteenth and Nineteenth Amendments. The case reached the Supreme Court, which did not rule in favor of the defendant. The judges explained that voting rights are determined by individual states. Furthermore, since Georgia’s poll tax affected everyone that met the voting requirements, it did not violate either the Fourteenth nor Nineteenth Amendments.

In Butler vs. Thompson (1951), a black female voter named Jessie Butler filed a civil suit against Mary Thompson, the Central Registrar of Arlington County, Virginia. Butler accused Thompson of preventing her from registering to vote. Thompson countered that Butler had not paid her poll taxes for the last three years. Butler argued that the poll tax was discriminatory against black voters, invalid because it violated the Act of Congress of 1870, and that it was created with “evil motives” by lawmakers. The District Court dismissed her case because there was no substantial Constitutional or Federal question presented by the complaint. However, this ruling was reversed in the United States Court of Appeals for the Fourth Circuit and ordered the District Court to re-address the case.

The Return of Voting Rights

During the 1930s and 1940s criticism and concern about poll taxes had increased, to where President Lyndon B. Johnson requested an investigation of poll taxes and other forms of voter restriction. The Red Scare of the 1950s temporarily put the matter on hold, but in 1962, an amendment was drawn repealing poll taxes. The Twenty-Fourth Amendment was passed, with the House voting 295-86 while the Senate voting 77-16. By 1964 most of the southern states surprisingly ratified it, with Mississippi being the only state that rejected it.

That same year, Congress passed the landmark Civil Rights Act, which prohibited discrimination based on color, race, religion, gender, or national origin at public locations such as movie theaters, restaurants, schools, parks, and hotels. It ended the racist Jim Crow laws and was a major victory for civil rights activists. The Civil Rights Act was considered to be one of the largest efforts at social reform since Reconstruction.

A year later Congress passed the Voting Rights Act, which eliminated literacy tests and required a federal oversight of voter registration in areas that have less than half of African-American citizens registered to vote. Noting that the Twenty-Fourth Amendment specifically refers to national elections, some states continued to disenfranchise eligible black voters with state and local poll taxes. After two major court cases (see the section on court cases below), the Supreme Court eventually ruled that all poll taxes at all levels, and all forms of substitutions, were unconstitutional.

WHAT DID THE TWENTY-FOURTH AMENDMENT DO?

The Twenty-Fourth Amendment repealed poll taxes as a requirement for voting in federal elections. Poll taxes were a type of Jim Crow law created by white supremacist southern lawmakers to disenfranchise black voters.

TWENTY-FOURTH AMENDMENT

Since the end of the Civil War, white supremacist lawmakers in southern states discriminated against African-Americans by hindering their societal, economical, and political progress. Although they were confined by Reconstruction and the Thirteenth, Fourteenth, and Fifteenth Amendments, they were still able to target black people at the state and local level, first with the Black Codes and post-Reconstruction with the Jim Crow laws.

The southern states did not want black Americans to have a say in politics and created a number of strict voting requirements that were impossible for most black Americans to fulfill, which included poll taxes. However, with the rise of the Civil Rights movement in the mid-20th century, societal attitudes started to shift, and the Twenty-Fourth Amendment ended the need for poll taxes in federal elections. The Voting Rights Act further eliminated other discriminatory voting requirements such as literacy tests and grandfather clauses.

TWENTY-FOURTH AMENDMENT COURT CASES

Since the ratification of the Twenty-Fourth Amendment, there have been some court cases regarding poll taxes.

In Harman vs. Forssenius (1965), the state of Virginia attempted to circumvent the impending Twenty-Fourth Amendment by removing the absolute requirement of a poll tax. Instead, they introduced a superficial element of choice, in that eligible voters must either produce a certificate of residence six months before the election, or pay the poll tax. The Supreme Court ruled that any form of poll tax or substitutions were considered unconstitutional.

In Harper vs. Virginia Board of Elections (1966), black voter Annie Harper could not register to vote because she could not pay Virginia’s poll tax. She sued the state, citing that her rights were violated under the Equal Protection Clause of the Fourteenth Amendment. The Supreme Court ruled in her favor, stating that voting eligibility has no connection to one’s wealth. Most importantly, the Supreme Court deemed all poll taxes at all levels to be unconstitutional, thus overruling the earlier decision from Breedlove vs. Suttles.