In Texas, a DUI can increase your car insurance rates by 52% to 85% on average. This is significantly higher than the cost of insurance for drivers with a clean record. In this article, the award-winning Texas DWI lawyers at Trey Porter Law answer the current top DUI car insurance questions, discuss essential DUI insurance resources, and address the questions surrounding how a DWI affects insurance for Texas drivers.

5 factors that affect insurance rates after a DUI in Texas:

- Insurance Company: Different insurance companies have different rates for drivers with a DUI.

- Driving Record: Insurance companies consider your driving history over the past 3-5 years.

- Coverage: The type of coverage you choose can affect your rate.

- Location: Where you live can affect your rate.

- Credit score: Your credit score can affect your rate.

3 Prime insurance consequences of a DUI conviction in Texas:

- Increased premiums: Your insurance company may double or triple your monthly costs.

- Policy cancellation: Some insurance companies may cancel your policy.

- SR-22 requirement: The state may require you to obtain an SR-22, which is a statement of financial responsibility. You must maintain a valid SR-22 for two years after conviction.

To reduce the financial impact of a DUI and car insurance, maintain a clean driving record, improve your credit rating, pay bills on time, and take a safe-driving course.

HOW MUCH DOES INSURANCE GO UP AFTER DUI IN TEXAS?

A Texas DUI results in a distinguishable auto insurance rate hike, though these increases vary across insurance providers.

On average, DUI offenders can see an increase of several hundred dollars a year on their car insurance. Some insurance companies may even refuse coverage following a DUI in Texas, according to the Texas Department of Insurance.

These insurance increases apply even in the case of a first-time DWI in Texas.

- Does DUI affect insurance in Texas? Yes, DUI’s often increase the cost of car insurance in Texas. Texas motorists can expect an increase of several hundred dollars a year in insurance premiums. Some companies will even deny coverage after DUI.

For example, Bankrate estimates a 52 percent insurance increase following a DUI in Texas.

- How long does a DUI affect insurance in Texas? A DUI can affect auto insurance rates for approximately 5 to 10 years in Texas, as outlined by Progressive Insurance.

Many insurance companies have different policies as to how far back they check Texas driving records. However, DUI is of particular concern for insurance companies so Texas motorists can expect increased vigilance for these offenses.

HOW LONG DOES DUI STAY ON INSURANCE IN TEXAS?

Insurance companies typically consider a DUI for 5 to 10 years in their rate and coverage calculus. A DUI is of great concern and can result in steep hikes and cancellation of coverage in some instances.

- What factors affect the cost of car insurance? Moving traffic violations, like Speeding and DUI offenses, impact car insurance costs. Motorists with multiple such violations are subject to steep rate increases or a denial of coverage altogether in some circumstances.

POTENTIAL INSURANCE COMPANY ACTIONS AFTER A TEXAS DUI

Texas drivers can expect insurance companies to greatly increase their premium rates following a DUI. Additionally, many jurisdictions require motorists to obtain a special DUI insurance policy following an offense. In certain circumstances, an insurance company can outright deny coverage.

In Texas, the Department of Public Safety requires motorists to maintain an SR22 insurance certificate following a DUI.

- Will my insurance cover me if I was drunk? Yes, an insurance company will cover monetary damages up to the individual policy limits regardless of whether the driver was intoxicated. However, an insurance company can refuse to issue any future policies or offer coverage to motorists with DUI offenses, as cautioned by the Texas Department of Insurance.

HOW DOES A DUI AFFECT YOUR INSURANCE?

A DUI can result in significantly increased insurance premium rates. Additionally, some companies may refuse to continue coverage altogether. An experienced DWI defense is the best way to beat a DUI and avoid these consequences.

- How far back do insurance companies check for DUI in Texas? Insurance companies employ different approaches to background checks involving DUI cases in Texas. As a general matter, insurance companies are particularly concerned with DUI cases within the previous 5-10 years, but can consider an entirety of a criminal record in their assessments. However, a DUI case that has been properly expunged will not appear on a background check in Texas.

CONSEQUENCES OF A DUI

A DWI conviction carries severe consequences, including short-term repercussions like license suspension, hefty fines, and potential jail time.

Long-term impacts are significant, with a permanent criminal record hindering employment prospects and significantly increasing car insurance premiums, potentially leading to policy cancellations.

Further DWI penalties may involve probation with conditions such as fines, drug testing, and mandatory classes, along with the requirement to install and maintain an ignition interlock device in your vehicle, and the obligation to fulfill community service hours.

WHAT HAPPENS WHEN YOU GET A DUI IN TEXAS?

A DUI can lead to jail time, monetary fines, and a permanent criminal conviction in Texas. A DUI can also result in a lengthy driver’s license suspension and a steep insurance rate increase.

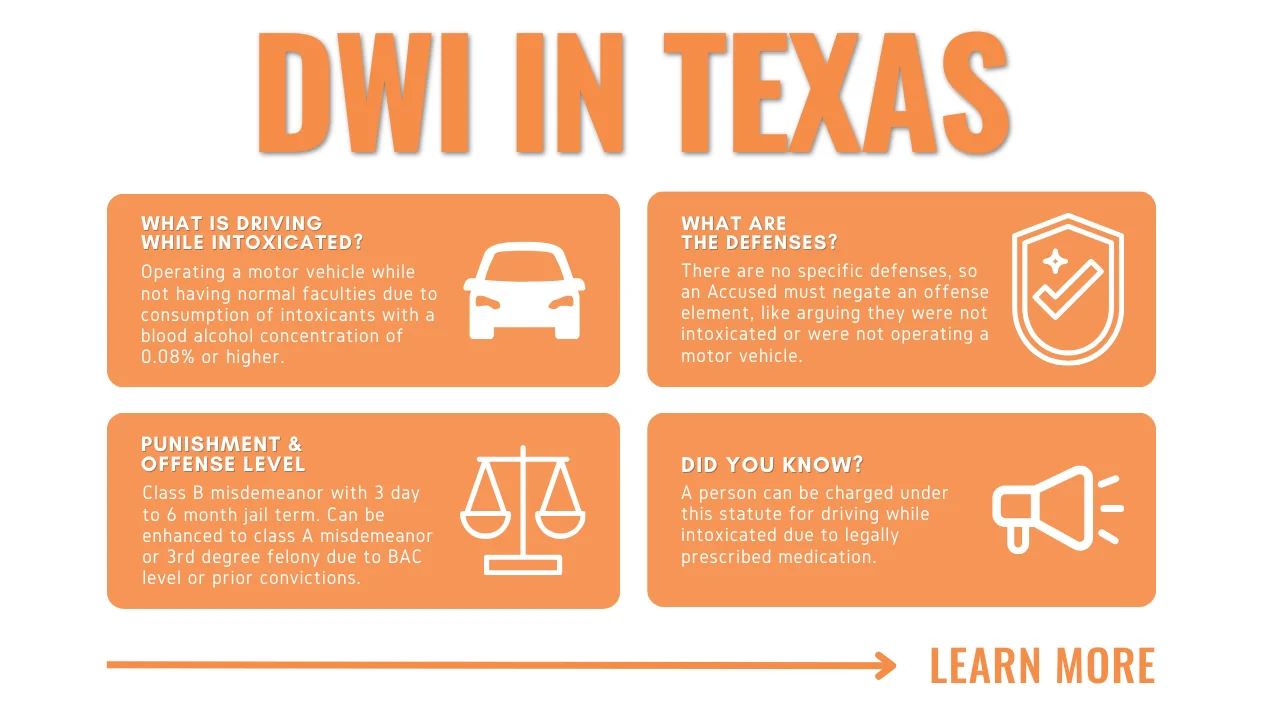

DWI is a severe criminal offense in Texas, normally punishable as a class B or class A misdemeanor under the Texas DWI Laws in Texas Penal Code section 49.04 .

Read our complete catalog of Texas DWI penalties here.

- How long does a DUI stay on record in Texas? A DUI stays permanently on Texas criminal and driving records even when dismissed. However, certain DWI cases may be removed from a record with an Expunction. Expunction is a powerful legal procedure that deletes all records of qualifying DUI cases.

The Texas Department of Public Safety’s Crime Record’s Division requires that DUI and criminal cases be entered into a person’s record – but these Texas background check laws do not apply to expunged cases, which ensures they remain hidden from public view!

Read our Texas Expungement Guide to find out what crimes can be expunged in Texas.

- Does Texas count out of state DUI? Yes, Texas considers any out-of-state DUI as a prior conviction for enhancement so long as the elements of the offense are sufficiently similar to the state statute.

For example, a person with a prior DUI conviction from California will face DWI 2nd charges following a DUI arrest in Texas.

These Texas DWI enhancements are set forth in the Texas DWI Enhancement Law of Texas Penal Code Section 49.09.

HOW LONG DO YOU LOSE YOUR LICENSE IN TEXAS FOR DUI?

As provided in Section 524 of the Texas Transportation Code , Motorists can lose their driver’s license for up to 2 years following a DUI in Texas. Additionally, CDL operators face stiffer license penalties, including lifetime CDL suspension in certain cases.

Drivers can avoid a license suspension altogether by contesting an ALR hearing in Texas with the Department of Public Safety.

- How long do you need SR 22 insurance after a DUI in Texas? As provided by the Texas Department of Public Safety, A driver must maintain a valid SR-22 insurance for two years after a DUI in Texas. Drivers who fail to maintain an SR-22 insurance are subject to additional enforcement actions and fines.

- How much does it cost to get a DUI expunged in Texas? DUI Expunction costs vary across Texas. Generally, it costs up to approximately $5,000 to expunge a DUI in Texas.

These costs are often affected by the severity of the case and the number of law enforcement agencies involved. Texas expungement procedures are governed by Chapter 55 and 55A of the Texas Code of Criminal Procedure.

HOW TO LOWER INSURANCE AFTER DUI?

A person can lower their insurance costs by immediately comparing quotes from different companies and avoiding further traffic violations like Speeding or DUI charges.

A motorist needs to demonstrate low risk through extended periods of good driving behavior. A clean driving record is one of the biggest factors in lowering car insurance, according to Progressive Insurance.

Texas Motorists can also lower insurance after a DUI by resolving any traffic citations with Deferred Disposition, which is a legal pathway to dismissal provided by Texas Code of Criminal Procedure Article 45A.302.

CAN YOU AVOID HIGHER INSURANCE RATES AFTER A TEXAS DUI?

There is no trick to hide a DWI from an insurance company or to otherwise prevent a rate increase following an offense. Insurance companies run diligent background checks, searching for all traffic and DUI violations.

- How much is DUI insurance per month? A DUI can increase car insurance significantly, with rate hikes varying between insurance companies and across jurisdictions. Car insurance can increase by several hundred dollars up to approximately a thousand dollars a year after a DUI. Additionally, a DUI can require special insurance coverage, such as SR-22, in many instances.

For example, Freeway Insurance estimates a DWI can increase insurance by 85 percent!

- How long does a DWI stay on your driving record in Texas? DWI cases remain permanently on driving records in Texas even when dismissed. However, some DWI cases may qualify for an Expunction, a powerful legal tool that deletes all records of a qualifying DWI case.

For in-depth information, check out our full article on how to get a DUI expunged here.

MINIMIZING THE FINANCIAL IMPACT OF A TEXAS DUI

A Texas DUI conviction can cause car insurance rates to skyrocket, with increases ranging from 52% to 85% on average. The financial impact depends on your insurance provider, driving history, and the severity of the offense, but some companies may even cancel coverage altogether.

Fortunately, there are ways to reduce the long-term costs. Comparing insurance quotes, completing a defensive driving course, and maintaining a clean driving record can help lower premiums over time. If you’ve been arrested for DWI in Texas, the best way to keep insurance costs down is to avoid a permanent conviction.

The battle-tested trial lawyers at Trey Porter Law have a proven track record of winning DWI cases, reducing fines, preventing license suspensions, and minimizing insurance penalties. Texans trust Trey Porter Law. Contact us today for a free case evaluation.