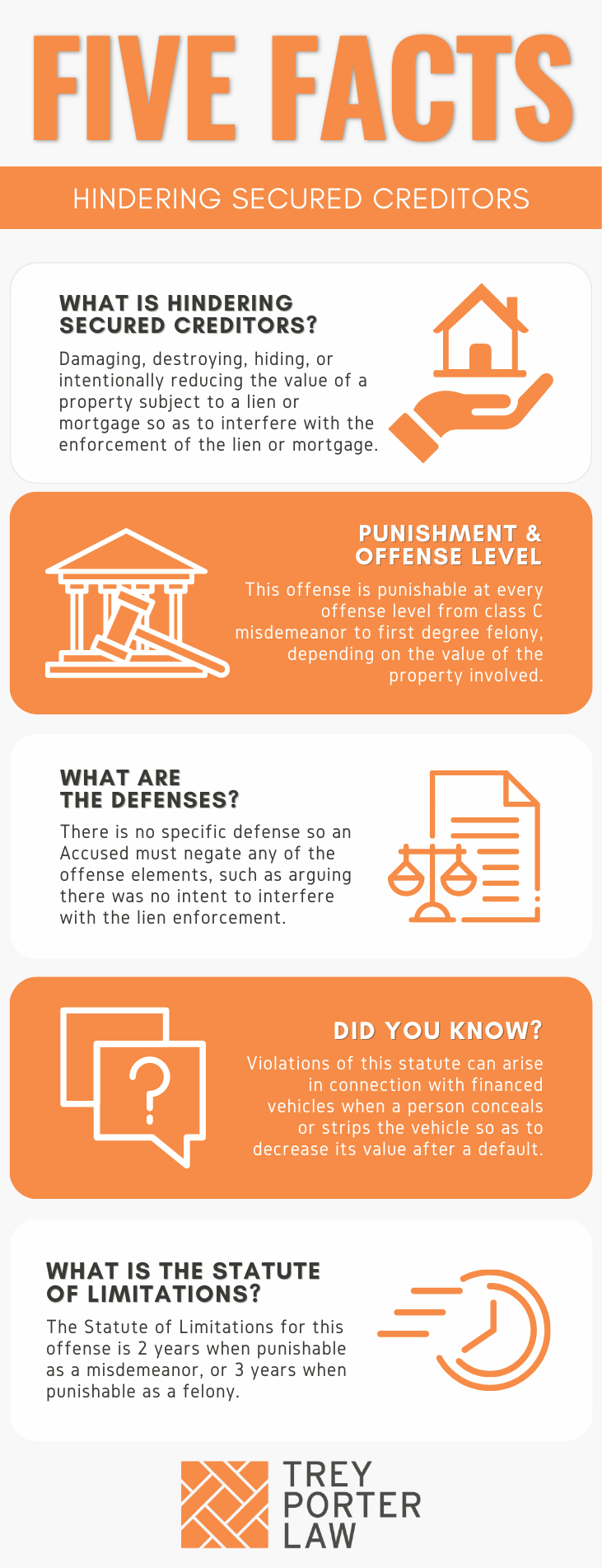

WHAT IS HINDERING SECURED CREDITORS IN TEXAS?

Defaulting on a loan secured by an asset or property pledged as collateral generally requires the defaulting party to relinquish the collateral. The law against hindering secured creditors criminalizes interfering with one’s security interest in the collateral.

WHAT IS THE HINDERING SECURED CREDITORS LAW IN TEXAS?

Tex. Penal Code § 32.33. HINDERING SECURED CREDITORS.

(b) A person who has signed a security agreement creating a security interest in property or a mortgage or deed of trust creating a lien on property commits an offense if, with intent to hinder enforcement of that interest or lien, he destroys, removes, conceals, encumbers, or otherwise harms or reduces the value of the property.

(c) For purposes of this section, a person is presumed to have intended to hinder enforcement of the security interest or lien if, when any part of the debt secured by the security interest or lien was due, he failed:

(1) to pay the part then due; and

(2) if the secured party had made demand, to deliver possession of the secured property to the secured party.

(d) An offense under Subsection (b) is a:

(1) Class C misdemeanor if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is less than $100;

(2) Class B misdemeanor if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is $100 or more but less than $750;

(3) Class A misdemeanor if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is $750 or more but less than $2,500;

(4) state jail felony if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is $2,500 or more but less than $30,000;

(5) felony of the third degree if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is $30,000 or more but less than $150,000;

(6) felony of the second degree if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is $150,000 or more but less than $300,000; or

(7) felony of the first degree if the value of the property destroyed, removed, concealed, encumbered, or otherwise harmed or reduced in value is $300,000 or more.

(e) A person who is a debtor under a security agreement, and who does not have a right to sell or dispose of the secured property or is required to account to the secured party for the proceeds of a permitted sale or disposition, commits an offense if the person sells or otherwise disposes of the secured property, or does not account to the secured party for the proceeds of a sale or other disposition as required, with intent to appropriate (as defined in Chapter 31) the proceeds or value of the secured property. A person is presumed to have intended to appropriate proceeds if the person does not deliver the proceeds to the secured party or account to the secured party for the proceeds before the 11th day after the day that the secured party makes a lawful demand for the proceeds or account. An offense under this subsection is:

(1) a Class C misdemeanor if the proceeds obtained from the sale or other disposition are money or goods having a value of less than $100;

(2) a Class B misdemeanor if the proceeds obtained from the sale or other disposition are money or goods having a value of $100 or more but less than $750;

(3) a Class A misdemeanor if the proceeds obtained from the sale or other disposition are money or goods having a value of $750 or more but less than $2,500;

(4) a state jail felony if the proceeds obtained from the sale or other disposition are money or goods having a value of $2,500 or more but less than $30,000;

(5) a felony of the third degree if the proceeds obtained from the sale or other disposition are money or goods having a value of $30,000 or more but less than $150,000;

(6) a felony of the second degree if the proceeds obtained from the sale or other disposition are money or goods having a value of $150,000 or more but less than $300,000; or

(7) a felony of the first degree if the proceeds obtained from the sale or other disposition are money or goods having a value of $300,000 or more.

WHAT IS THE PENALTY CLASS FOR HINDERING SECURED CREDITORS IN TEXAS?

The penalty category for hindering secured creditors depends on the value of the property destroyed, removed, concealed, or harmed, or the amount of proceeds appropriated. If the property value or proceeds is:

- Less than $100:

- Class C misdemeanor, punishable by up to a $500 fine, and no jail time;

- $100 to $749:

- Class B misdemeanor, punishable by up to 180 days in county jail;

- $750 to $2499:

- Class A misdemeanor, punishable by up to one year in county jail;

- $2500 to $29,999:

- State jail felony, punishable by 180 days to two years in a state jail facility;

- $30,000 to $149,000:

- Third degree felony, punishable by two to ten years in prison;

- $150,000 to $299,999:

- Second degree felony, punishable by two to 20 years in prison;

- $300,000 or more:

- First degree felony, punishable by five to 99 years or life in prison.

WHAT IS THE PUNISHMENT RANGE FOR HINDERING SECURED CREDITORS IN TEXAS?

The punishment range for hindering secured creditors increases with the value of property or amount of proceeds appropriated:

- Class C misdemeanor, if the value is less than $100:

- maximum fine of $5,000, no jail time;

- Class B misdemeanor, if the value is $100 or more but less than $750:

- up to 180 days in jail, maximum fine of $2,000;

- Class A misdemeanor, if the value is $750 or more but less than $2,500:

- up to one year in jail, maximum fine of $4,000;

- State jail felony, if the value is $2,500 or more but less than $30,000:

- 180 days to two years in a state jail facility, maximum fine of $10,000;

- Third degree felony, if the value is $30,000 or more but less than $150,000:

- two to ten years in prison, maximum fine of $10,000;

- Second degree felony, if the value is $150,000 or more but less than $300,000:

- two to 20 years in prison, maximum fine of $10,000;

- First degree felony, if the value is $300,000 or more:

- five to 99 years or life in prison, maximum fine of $10,000.

WHAT ARE THE PENALTIES FOR HINDERING SECURED CREDITORS IN TEXAS?

A person charged with hindering secured creditors may be eligible for probation after a conviction, or deferred adjudication without a conviction.

- What is the maximum length of probation for hindering secured creditors in Texas? If a person is convicted of a Class C misdemeanor, the only punishment is a maximum fine of $500. But a person may be placed on probation for up to two years if convicted of a Class A or Class B misdemeanor. For state jail and third degree felony hindering charges, the probation term may range from two to five years, and may not exceed ten years for second degree and first degree felonies.

- What is the maximum length of deferred adjudication for hindering secured creditors in Texas? To avoid a hindering secured creditors conviction, a person may plead guilty or nolo contendere (“no contest”) to a judge, and be placed on deferred adjudication. The period of deferred adjudication may not exceed 180 days for a Class C misdemeanor, or two years for a Class A or Class B misdemeanor. The deferred adjudication term for a state jail felony is between two and five years, with the possibility of extending it up to ten years. The deferred adjudication term may not exceed ten years for first degree, second degree, and third degree felonies.

WHAT ARE THE DEFENSES TO HINDERING SECURED CREDITORS IN TEXAS?

The statute does not authorize specific defenses to hindering secured creditors. A person accused thereof may assert any defense in an attempt to negate at least one of the elements the State must prove at trial. For example, the State must show the accused intended to hinder enforcement of the lien or security interest by his or her conduct, which may be contradicted by the defense.

WHAT IS THE STATUTE OF LIMITATIONS FOR HINDERING SECURED CREDITORS IN TEXAS?

The limitation period for hindering secured creditors categorized as a misdemeanor is two years. If classified as a felony, the limitation period for hindering secured creditors is three years.

HINDERING SECURED CREDITORS IN TEXAS

A person commits hindering secured creditors by interfering with a security interest in property or assets pledged as collateral. Texas law protects lenders who attempt to legally retrieve their agreed-upon property or the proceeds therefrom, and punishes people criminally for violating the binding agreement.

TEXAS HINDERING SECURED CREDITORS COURT CASES

The case law regarding hindering secured creditors in Texas demonstrates how civil matters become punishable as criminal offenses.

In Paredez v. State, the defendant signed three promissory notes with a credit union, and a security agreement protecting the credit union’s interest in a truck the defendant purchased. He became delinquent on the notes, and the credit union attempted to repossess the truck. Despite notices, and legal process, including a default judgment, he refused to disclose the truck’s location. He returned it months later without a motor or transmission. The defendant was convicted of hindering a secured creditor by concealing the property, in the amount of $2,500 to $30,000, and the appellate court upheld his conviction. No. 07-18-00412-CR (Tex. App.—Amarillo, no pet.).

In Schmutz v. State, the defendant owned a farm and ranch equipment retail store, and bought his store merchandise on consignment from the victim manufacturer. The defendant closed his store and filed for bankruptcy, but owed the victim nearly $90,000. He admitted he had used the proceeds from equipment sales to pay other financial obligations, and was convicted of hindering a secured creditor by misappropriating proceeds of secured property. The Court of Criminal Appeals affirmed. 440 S.W.3d 29 (Tex. Crim. App. 2014).