WHAT IS CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS?

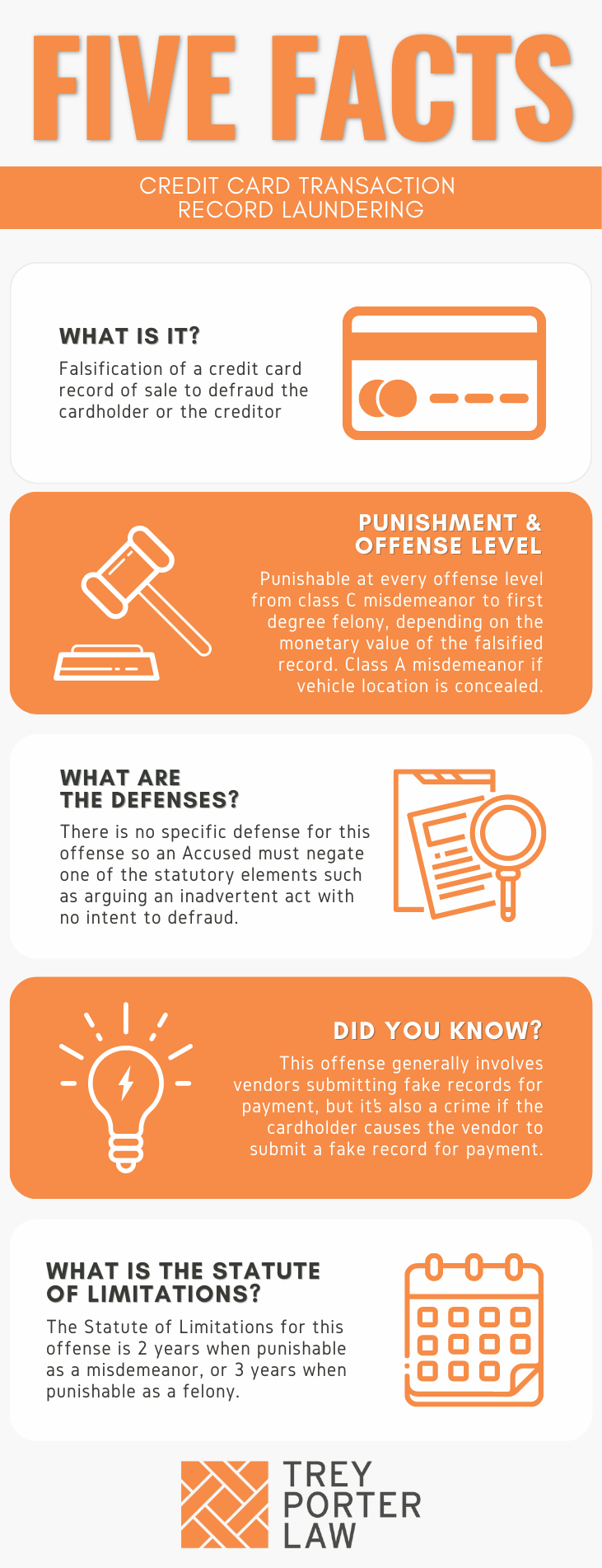

Credit card transaction record laundering occurs when a vendor submits a record of a sale that never actually occurred to a credit card company for payment.

WHAT IS THE CREDIT CARD TRANSACTION RECORD LAUNDERING LAW IN TEXAS?

Tex. Penal Code § 32.35. CREDIT CARD TRANSACTION RECORD LAUNDERING.

(b) A person commits an offense if the person is an authorized vendor who, with intent to defraud the creditor or cardholder, presents to a creditor, for payment, a credit card transaction record of a sale that was not made by the authorized vendor or the vendor’s agent.

(c) A person commits an offense if, without the creditor’s authorization, the person employs, solicits, or otherwise causes an authorized vendor or the vendor’s agent to present to a creditor, for payment, a credit card transaction record of a sale that was not made by the authorized vendor or the vendor’s agent.

(d) It is presumed that a person is not the agent of an authorized vendor if a fee is paid or offered to be paid by the person to the authorized vendor in connection with the vendor’s presentment to a creditor of a credit card transaction record.

(e) An offense under this section is a:

(1) Class C misdemeanor if the amount of the record of a sale is less than $100;

(2) Class B misdemeanor if the amount of the record of a sale is $100 or more but less than $750;

(3) Class A misdemeanor if the amount of the record of a sale is $750 or more but less than $2,500;

(4) state jail felony if the amount of the record of a sale is $2,500 or more but less than $30,000;

(5) felony of the third degree if the amount of the record of a sale is $30,000 or more but less than $150,000;

(6) felony of the second degree if the amount of the record of a sale is $150,000 or more but less than $300,000; or

(7) felony of the first degree if the amount of the record of a sale is $300,000 or more.

WHAT IS THE PENALTY CLASS FOR CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS?

The penalty category for credit card transaction record laundering depends on the amount of the record of a sale. If the amount is:

- Less than $100:

- Class C misdemeanor, punishable by up to a $500 fine, and no jail time;

- $100 to $749:

- Class B misdemeanor, punishable by up to 180 days in county jail;

- $750 to $2499:

- Class A misdemeanor, punishable by up to one year in county jail;

- $2500 to $29,999:

- State jail felony, punishable by 180 days to two years in a state jail facility;

- $30,000 to $149,000:

- Third degree felony, punishable by two to ten years in prison;

- $150,000 to $299,999:

- Second degree felony, punishable by two to 20 years in prison;

- $300,000 or more:

- First degree felony, punishable by five to 99 years or life in prison.

WHAT IS THE PUNISHMENT RANGE FOR CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS?

The punishment range for credit card transaction record laundering increases with the amount of the record of sale:

- Class C misdemeanor, if the amount is less than $100:

- maximum fine of $500, no jail time;

- Class B misdemeanor, if the amount is $100 or more but less than $750:

- up to 180 days in jail, maximum fine of $2,000;

- Class A misdemeanor, if the amount is $750 or more but less than $2,500:

- up to one year in jail, maximum fine of $4,000;

- State jail felony, if the amount is $2,500 or more but less than $30,000:

- 180 days to two years in a state jail facility, maximum fine of $10,000;

- Third degree felony, if the amount is $30,000 or more but less than $150,000:

- two to ten years in prison, maximum fine of $10,000;

- Second degree felony, if the amount is $150,000 or more but less than $300,000:

- two to 20 years in prison, maximum fine of $10,000;

- First degree felony, if the amount is $300,000 or more:

- five to 99 years or life in prison, maximum fine of $10,000.

WHAT ARE THE PENALTIES FOR CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS?

A person charged with credit card transaction record laundering may be eligible for probation after a conviction, or deferred adjudication without a conviction.

- What is the maximum length of probation for credit card transaction record laundering in Texas? If a person is convicted of a Class C misdemeanor, the only punishment is a maximum fine of $500. But a person may be placed on probation for up to two years if convicted of a Class A or Class B misdemeanor.For state jail and third degree felony credit card transaction record laundering charges, the probation term may range from two to five years, and may not exceed ten years for second degree and first degree felonies.

- What is the maximum length of deferred adjudication for credit card transaction record laundering in Texas? To avoid a credit card transaction record laundering conviction, a person may plead guilty or nolo contendere (“no contest”) to a judge, and be placed on deferred adjudication. The period of deferred adjudication may not exceed 180 days for a Class C misdemeanor, or two years for a Class A or Class B misdemeanor.The deferred adjudication term for a state jail felony is between two and five years, with the possibility of extending it up to ten years. The deferred adjudication term may not exceed ten years for first degree, second degree, and third degree felonies.

WHAT ARE THE DEFENSES TO CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS?

The statute does not authorize specific defenses to credit card transaction record laundering. A person accused thereof may assert any defense in an attempt to negate at least one of the elements the State must prove at trial. For example, the intent to defraud the creditor or cardholder is an element, so a vendor may show he or she submitted duplicate transactions inadvertently, without the intent to defraud.

WHAT IS THE STATUTE OF LIMITATIONS FOR CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS?

The limitation period for credit card transaction record laundering categorized as a misdemeanor is two years. If classified as a felony, the limitation period is three years.

CREDIT CARD TRANSACTION RECORD LAUNDERING IN TEXAS

Credit card transaction record laundering occurs when vendors defraud credit card companies by sending fraudulent records of sales for payment.